Receive FDIC insurance coverage up to $10 million through the IntraFi Network.4

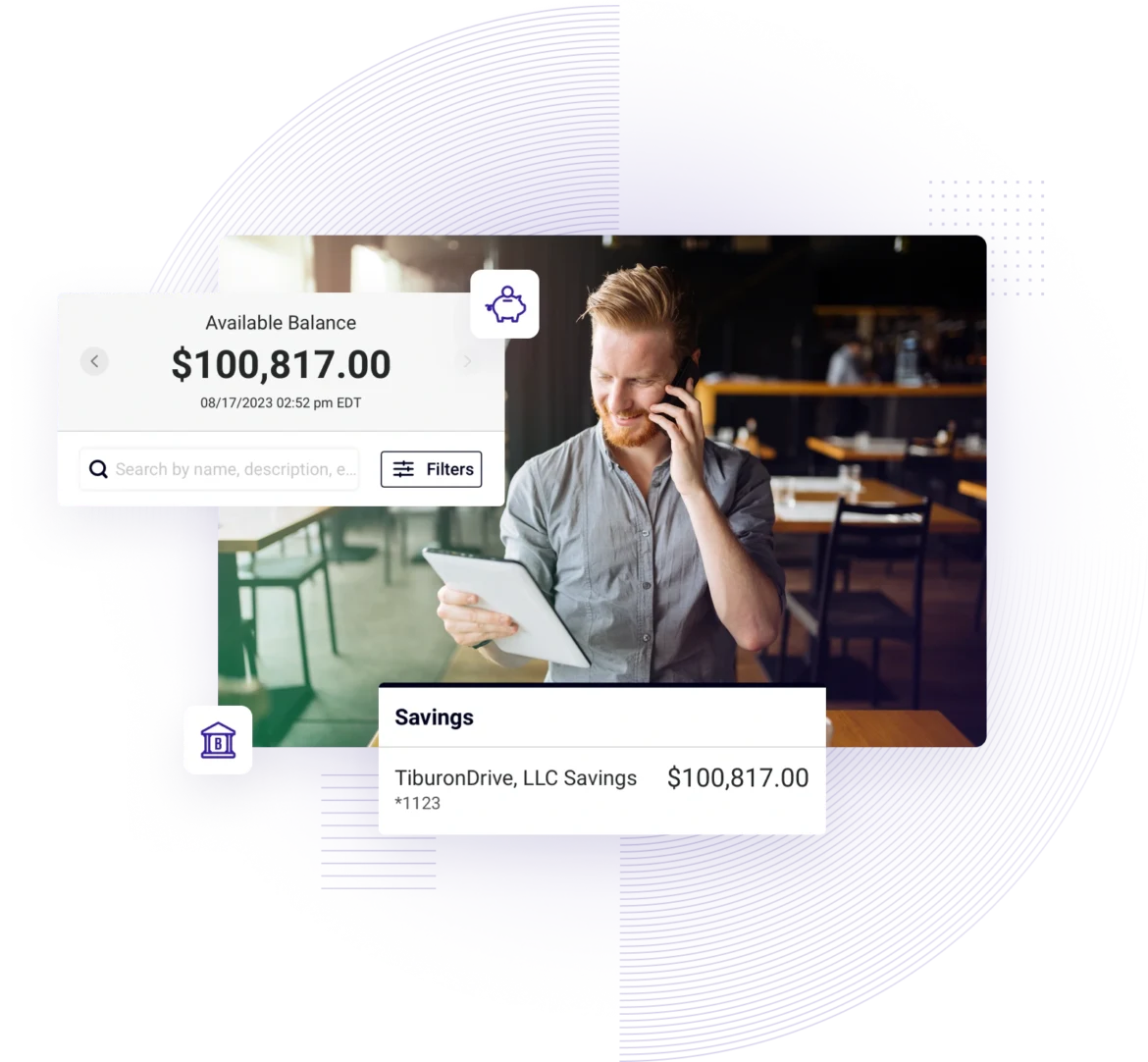

Business Savings Account

Save smarter with a top rate, no maintenance fees and FDIC insurance.

Earn and save more with & APY1

Earn &x the national average APY.2

Our savings calculator shows you how our competitive interest rate grows your account over time.

Features and Benefits

High-Yield Rate

Your account will grow because we stay competitive.

FDIC Insured3

Funds are insured up to the maximum allowed by law.

Online Account Opening

Easily manage your account and add authorized signers.

Connect with QuickBooks

Manage your business finances by linking your account.

No Monthly Maintenance Fees

We don’t require you to keep minimum balance to avoid fees.

Insured Cash Sweep Account

Minimize Risk

Protect assets beyond $250,000 while earning a competitive savings rate.

No Fees

Receive extended FDIC insurance coverage4 at no extra cost to you.

Centralized Relationship

No need to work with multiple banks when you can access additional FDIC insurance through one login at a superior rate.

Business Savings Accounts FAQ

To ensure your account is closed properly please contact us at 866.518.0286 (Monday through Friday 8:00 a.m. – 8:00 p.m. ET).

Yes, you may add up to four additional authorized signers for the Business Savings account (for a total of five authorized signers). Authorized signers must be a U.S. citizen or Permanent Resident and listed on the Entity Authorization provided at account opening.

Deposits begin earning interest on the day the deposit is posted to your account. Please allow 1-2 business days for an incoming ACH transfer initiated through the Live Oak Bank Portal to post to your account.

Check deposits are posted to the account on the day we receive them. Interest is compounded daily and posted to your account on the last business day of the month. You must have a balance of $.01 to earn interest.

You may initiate an ACH transfer from your external bank account through the Live Oak Bank Portal. The cutoff time for incoming and outgoing ACH transfers is 4:00 p.m. ET. Please allow 1-2 business days for the funds transfer to process. For security and verification purposes, incoming transfers initiated through the Live Oak Bank Portal are held for five business days once posted to your Live Oak account.

ACH transfers initiated from an external account and sent to your Live Oak account are available immediately upon receipt.

Deposits made by check or mobile deposit will be held for up to five business days once posted to your account.

Funds sent to an external account are available at that bank within 1-2 business days. The transfer must be initiated before 4:00 p.m. ET.

- You can transfer funds electronically through an ACH transaction. To do this, log on to the Live Oak Portal and choose the ‘Transfer Funds’ option. You may transfer funds between your Live Oak accounts and your linked external accounts. Please allow 1-2 business days for the transfer to process.

- Mail your check to our Headquarters:

Live Oak Bank

Attention: Deposits

1757 Tiburon Drive

Wilmington, NC 28403* Please note we do not accept checks drawn on foreign banks, third-party checks or cash deposits. (A third-party check is a check that is signed over to an individual not named on the front of the check - Deposit a check with the Live Oak Bank Mobile App. Deposit limits apply. The mobile deposit cutoff time is 4:00 p.m. ET. Deposits received after 4:00 p.m. ET will be processed on the following business day.

- Wire funds into your account. Log on to the Live Oak Portal for wire instructions. You must have an open account to deposit by wire. A new account cannot be opened by wire. (please click here to see our fee schedule for applicable fees).

Live Oak Bank will not accept cash deposits.