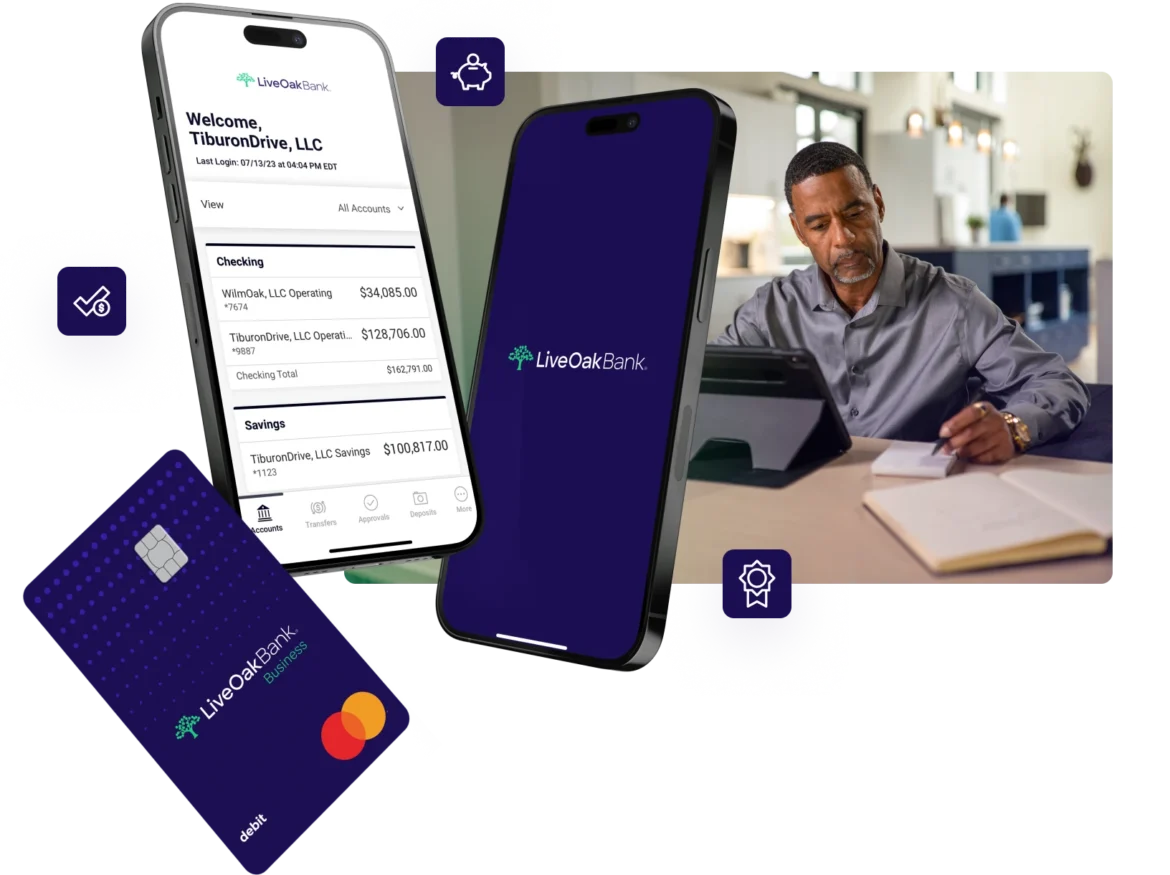

As a digital bank, we don’t have branches. This means we’re able to fully focus on providing you top-notch service and the solutions your business needs.

We Make Business Banking Easy

Our digital deposit products help you stay focused on what’s important.

Our Approach Could

Benefit Your Bottom Line

Business Checking

Your Way

Choose a checking account that meets the needs of your business.

Business Plus

Ideal for businesses requiring ACH, online wire services or more robust features.

Business Plus Analysis

Ideal for businesses with high daily balance in need of statement aggregation and broader capabilities.

Save Smarter

With Us

Earn &x the national average APY.2

We’re committed to offering high-yield interest rates and reliable digital service so that your savings can grow strong.